Selling your home can be a major life event. It's important to understand the federal tax implications before you put your house on the market. One of the biggest concerns for homeowners is how to minimize their federal tax liability when they sell their house.

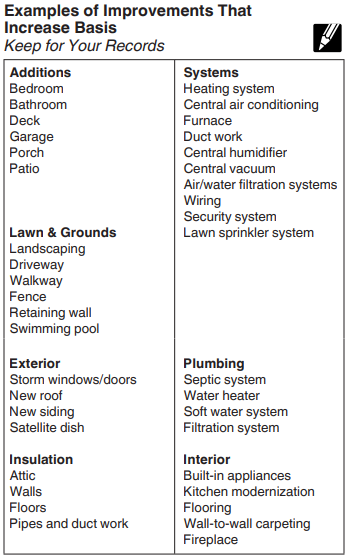

The Internal Revenue Service (IRS) plays an important role in the sale of your home. When you sell your home, you may be required to pay taxes on the capital gain. This is the difference between the sale price and your adjusted basis. (the purchase price plus any improvements you've made to the home, minus depreciation)

Minimizing your tax liability when selling your house takes careful planning and understanding of the applicable tax regulations.

By implementing these strategies and seeking professional guidance when needed, you can effectively minimize your tax liability when selling your house and maximize your financial gains.

In addition to the home sale exclusion, there are a number of other deductions that you may be able to claim when you sell your home. These deductions may include expenses related to selling your home, such as real estate commissions and closing costs. You may also be able to deduct certain home improvements that you made in the years leading up to the sale.

If you are selling your home, it is important to report the sale on your tax return. You will need to report the sale price of your home, your adjusted basis, and any capital gains or losses that you realized from the sale. You may also need to report any deductions that you are claiming related to the sale of your home. Selling your home can be a complex process, but it doesn't have to be overwhelming. By following these tips, you can ensure that you are reporting the sale of your home to the IRS correctly and minimizing your tax liability.

Blue Heron CPAs often performs business consulting for those thinking about forming an S Corporation. There are many questions we ask that go far beyond the tax liability, like reasonable compensation. To ensure that an S Corporation is the right entity structure for our clients as it relates to taxes. Much of those questions relate to managing basis, paying yourself in an S Corporation, and the expected normal operations of the company. Understanding the consequences of making an S election is important.

This article identifies potential red flags that we commonly see in S Corporations. This article does not identify all errors or all issues we commonly see. This resource intends to help individuals educate themselves through proper communication with their tax preparers. Your tax preparer should be capable of having a conversation towards any of the below topics. This will help further qualify whether that preparer is the correct person for the service you are being provided.

Many small business owners form S Corporations to take advantage of significant tax benefits, especially those related to self-employment taxes. However, navigating the complexities of S Corporation operations can be challenging. Prior to electing an S Corporation, you should evaluate the complexities for whether you intend to comply with the law. In this blog article, we'll explore three common issue areas we see in S Corporations: reasonable compensation, managing your basis, and mileage for personal cars. Many tax preparers put the responsibility of compliance for these requirements on the taxpayer. Taxpayers are responsible for accurately and properly filing their tax returns and following the rules and regulations for their respective entities.

One of the most critical issues for S Corporation owners is paying yourself in an S Corporation, also known as "reasonable compensation." The IRS closely scrutinizes the salary that owners pay themselves. This prevents individuals from reducing their tax liability by paying too little in wages and taking the rest as distributions. Here are some key points to consider when paying yourself in an S Corporation:

Reasonable compensation is the salary an S Corporation owner or shareholder should pay themselves for their work within the business. There is no direct guidance on how to calculate reasonable compensation but the IRS guidance below discusses a potential calculation.

Proper documentation on how you came to your salary number is crucial. Maintain records of salary surveys, job descriptions, and any other information that supports the chosen salary level. This documentation is invaluable in case of an IRS audit.

Reasonable compensation is subject to payroll taxes (Social Security and Medicare), while distributions are not. Paying too little in salary can lead to IRS penalties and additional tax liabilities including their ability to classify past distributions as wages.

There are consequences to underpaying self-employment tax. When calculating a Social Security benefit during retirement, reduced wages can heavily reduce the future benefit you receive.

“I was reading into S Corporation requirements, and it mentions reasonable compensation as a requirement to operate as an S Corporation. Should I be on the company’s payroll and am I taking the proper amount of salary?”

To ensure compliance, it's advisable to consult with a tax professional. A professional can help determine a reasonable compensation level that aligns with IRS guidelines and industry standards.

Basis in an S Corporation is the investment that the shareholders have in the company. Like understanding the cost of what you put into a house when you sell it or stocks as you sell them, you have a basis in your company. The IRS requires taxpayers to track their basis, a crucial calculation for tax purposes. Basis may not affect your income and the taxes you owe every year which is why it is a hidden dagger that has severe tax consequences in future years.

Basis can increase through various means. I usually think of this as putting additional investment into the business.

Your company’s basis is recognized through Schedule M-2 which is located on Page 5 of the 1120-S. It is required for every S Corporation to track and report basis properly. On your individual return, a Form 7203 is likely filed to report the individuals basis within the S Corp.

Signs of basis mismanagement include the following common red flags. If you see any of the following, it is worth asking your accountant if your basis is accurately tracked and why it is reported this way. The below does not identify that a mistake has been made. It identifies that there is a high likelihood that you should talk to your accountant.

“I was reading into S Corporation requirements to manage your basis. I was hoping you might be able to explain the Schedule M-2 to me along with my Form 7203.”

To properly manage your basis, work closely with a tax professional who specializes in S Corporations. They can help you establish a basis tracking system, maintain accurate records, and ensure that you're compliant with IRS regulations.

Have you ever been advised by TikTok or a friend to title a new vehicle under the business because it becomes a tax deduction? Your friend might be right, but they are likely not explaining the entire story for how you must treat that vehicle for the future. S Corporation owners often use personal vehicles for business purposes. S Corporation owners also may use business vehicles for personal use. Keep in mind that shareholders who are actively working within the S Corporation are considered employees of the S Corporation. Properly handling vehicle expenses is essential for tax efficiency but also a requirement to the IRS which reduces tax liabilities. Here are some key considerations:

There is not great guidance specifically towards the topic of vehicles held in S Corporations. There are common mistakes around vehicle deductions through business vehicles titled in the business’ name.

I have been researching how to get the maximum amount of deduction for my business vehicle and I came across an article describing the mileage reimbursement for personal vehicles. Are we currently performing a reimbursement and are we claiming a deduction?

I hope this article is helpful to those who have trouble approaching tough conversations about accounting and taxes. It is important to remember that the taxpayer, you, is ultimately responsible for your tax return and the numbers included on that return.

S Corporations offer numerous advantages, but they also come with complexities that require careful attention. Understanding reasonable compensation, basis, and mileage reimbursement rules is crucial for maintaining compliance with tax regulations and optimizing your tax strategy. Consulting with tax professionals, keeping accurate records, and managing basis effectively will help you navigate these challenges successfully and maximize the benefits of your S Corporation structure.

As tax season approaches, one of the most critical decisions you'll make is choosing the right tax preparer who can navigate the complex world of taxation while ensuring your financial well-being. Not all tax professionals are created equal and attention to detail is the largest quality to the accuracy of your tax preparer. To help you make an informed choice, we've compiled a guide on essential certifications and qualifications you should be looking for when finding and qualifying a tax preparer.

Anyone with an IRS Preparer Tax Identification Number (PTIN) is authorized to prepare federal tax returns. To obtain a Preparer Tax Identification Number (PTIN), individuals must go through a quick registration process with the IRS. However, the qualifications necessary to identify yourself as a tax preparer are very low and there are no educational requirements.

Based on demand and the ability to easily set up a business, many seasonal tax firms pop up around Florida. Seasonal tax preparers are often hired temporarily during tax season to handle the influx of returns. They may not always possess the necessary credentials, making them more susceptible to becoming ghost preparers. It's crucial for taxpayers to exercise caution when seeking assistance from such preparers. Even though some seasonal preparers may be legitimate and have the requisite skills, it's essential to verify their qualifications. You should ask for their PTIN, and ensure they are associated with a reputable tax preparation service or organization. Being diligent in your selection process can help you avoid the potential pitfalls associated with ghost preparers and ensure that your tax return is handled accurately and ethically.

Typically, looking for an accounting firm is a good way to avoid unqualified tax preparers. Each state also has their own requirements for marketing and the naming of an accounting firm. In Texas, the law does not allow you to identify as an Accountant in your name unless you hold a Certified Public Accountant License. In Florida, there are very few rules when starting an accounting firm and there are very few restrictions on what you can name a business. Thus, a person with no qualification can start an accounting firm tomorrow within Florida.

If you are specifically looking for a certified individual to perform your work. Looking for a business with “CPAs” within its name is important. CPA firms must have the majority of their ownership owned by a CPA. The reason why the “s” is so important is that it indicates multiple CPAs are involved within the ownership. Firms with multiple certified individuals perform better as the firm is less likely to rely on one person to make decisions. This increases the ability of the firm to prepare an accurate return and also typically reflects a larger amount of knowledge in the firm. If you do not require a CPA firm to perform your work, it is much harder to qualify a preparer for your tax return through the business’ name.

There are many important qualities to think about when choosing a tax preparer. The most important one is whether the preparer has the ability to defend their work in front of the IRS. You will find this quality important if you receive an IRS Audit letter in the future. If your preparer is not able to defend each step of an IRS Audit, you will need to involve additional individuals which may cost substantially more in your defense.

Enrolled Agents are tax experts licensed by the IRS. They must pass a three-part exam, demonstrating proficiency in federal tax planning, individual and business tax return preparation, and representation. EAs are required to complete 72 hours of continuing education every three years. Enrolled Agents are certified in Tax services which includes portions of accounting. The certification’s tests focus on tax compliance and tax return preparation for individuals and businesses. Typical services performed by Enrolled Agents include tax preparation, tax planning, IRS Representation, and many other tax related services.

CPAs are licensed by state boards of accountancy. They have passed the Uniform CPA Examination, which is a 4 part exam. CPAs have taken 150 hours of college credit, much of which must be high level accounting courses, and typically have a Bachelor’s degree. CPAs also must meet experience and ethical requirements and engage in ongoing continuing education to maintain their CPA license. The CPA license is intended to be the most broad and prestigious license in Accounting.

The Uniform CPA Examination is known to be one of the hardest exams to pass. By identifying a CPA as your preferred tax preparer certification, you are guaranteeing a well-rounded accountant is preparing your return. Each part of the 4 part exam has a pass rate around 50% along with an average study period of over 12 months. Therefore, utilizing a CPA for your tax preparation is considered to be the safest option if you are qualifying a tax preparer by their certification.

In regards to tax preparation, not every CPA has the knowledge to perform tax preparation well. Qualifying that the CPA has a focus on tax preparation and tax strategies is a good idea when looking for a tax preparer. Typical services performed by a CPA include all tax services, accounting services, advisory and audit services, along with almost every other service in accounting. Just keep in mind that CPAs should not identify as being good at all services and typically have a specialization such as tax return preparation.

Attorneys are licensed by state courts or their designees, such as the state bar. They have earned a degree in law and passed a bar exam. Attorneys are held to high ethical standards and must participate in ongoing continuing education. Most attorneys performing tax preparation are tax attorneys. Tax attorneys typically have extensive and specialized knowledge in accounting and tax.

Tax preparers without the above-mentioned credentials, have limited practice rights. They can only represent clients before specific IRS employees but not in appeals or collection issues. These preparers include:

To assist taxpayers in determining the credentials and qualifications of tax professionals, the IRS maintains a public directory. This searchable database includes the names, locations, and credentials of attorneys, CPAs, enrolled agents, enrolled retirement plan agents, and enrolled actuaries with valid PTINs, as well as Annual Filing Season Program Record of Completion recipients for the current tax year.

It is crucial to ensure that your tax preparer holds the necessary credentials and qualifications to handle your financial affairs effectively. For this reason, always verify that your tax preparer has an IRS-issued PTIN, which is required by law for anyone who prepares tax returns for compensation. When selecting a tax professional, inquire about their education, training, and experience to make an informed choice. Your financial well-being depends on it, so choose wisely and with confidence.